A few days ago the EIA published the latest update to its International Energy Statistics. The data is updated through May 2014. The data on all charts below is through May unless otherwise stated and is in thousand barrels per day. Also, all data is Crude + Condensate.

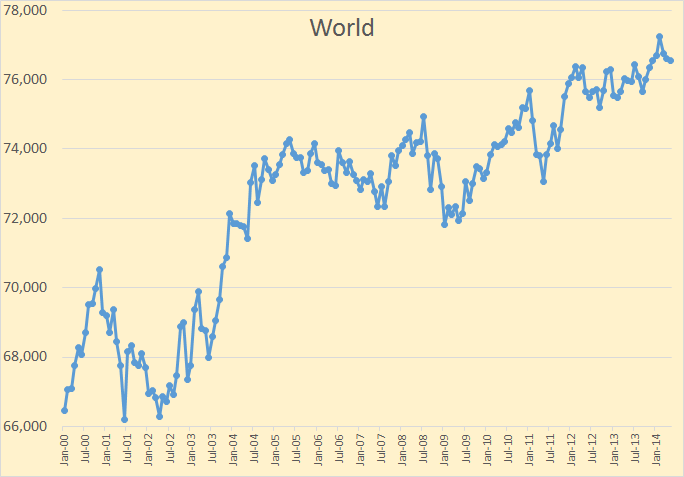

World C+C production was down 72,000 barrels per day in May to 76,540,000 bpd. It was down 708,000 barrels per day since reaching a new all time peak in February of 77,247,000 bpd.

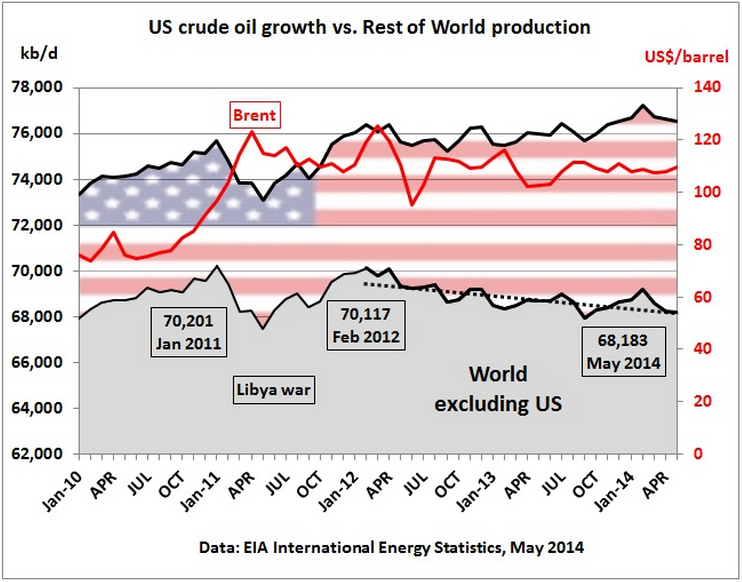

Matt, on his blog Crude Oil Peak, is saying the same thing I have been saying for months. That is US shale oil growth covers up production drop in rest-of-world.

The trend is clearly down and is going to get worse. Below is my graph using the same data.

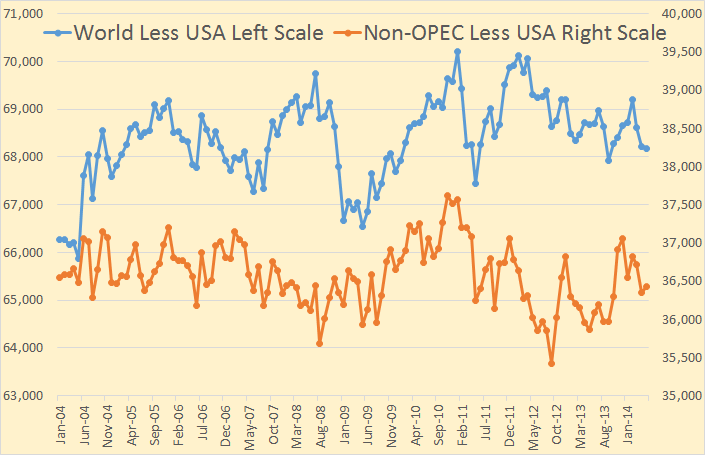

World C+C production, less USA, is down about 2 million barrels per day since the all time peak. In the past decade world less USA has been up and down many times but I have reason to believe that this time it will not be up again. There are several reasons for this and it involves the peaking of several other countries that have shown considerable increase in the last few years. Not the least of which is Russia.

Russia, the world’s largest crude oil producer, has peaked. Russia is now in decline. Russian C+C production increased about 2,300,000 barrels per day 2005, the year that World conventional oil peaked.

Without sanctions Russia peaked in November 2013 and would have likely started dropping at 1 to 2 percent per year. But with sanctions the drop is likely to be much faster than that. We had this headline just this morning:

Russian crude oil exports seen down 6pc in Q4

MOSCOW: Exports of seaborne Russian Urals and ESPO crude oil blends were seen declining by 6.2 percent to 50.17 million tonnes in the last three months of the year from the previous quarter, traders said on Monday, citing a quarterly loading schedule.

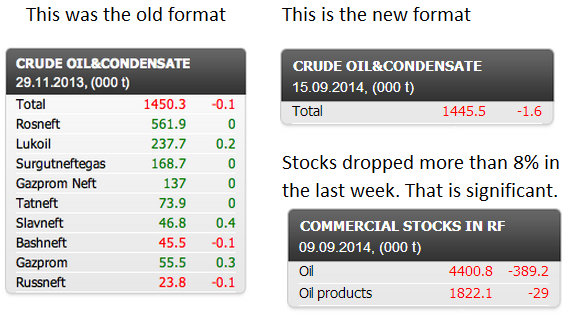

Some of the decline was due to increased input to Russian refineries but it is likely much of it is due to reduced Russian production. And speaking of Russian Production I am getting suspicious of their reporting. They have completely changed the format at their site CDU TEK.

They no longer report production from individual companies, just total production. I think it may be possible that they are doing the same thing as Iran after their sanctions. Iran showed no decline whatsoever in their production numbers for almost a year after sanctions were imposed. And they still show about a quarter of a million barrels per day more than the rest of the world sees as Iran’s production.

Perhaps Russia has the same motivation but don’t want to bring individual companies into their deception… so they just dropped them from their reporting page. I just threw in the “Commercial Stocks in RF” block because I found it interesting.

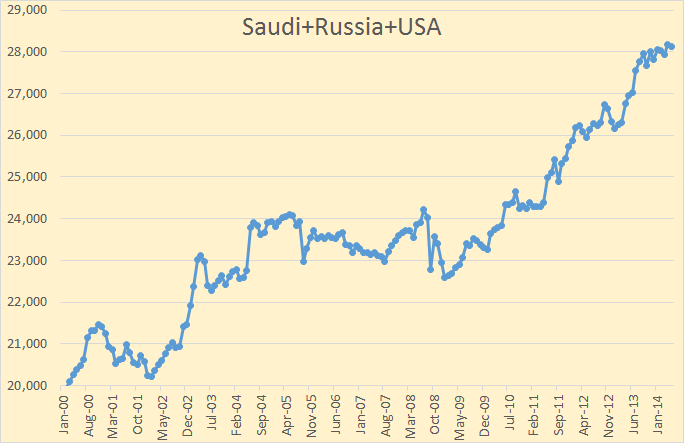

Anyway, let’s look at the world’s three largest oil producers.

Saudi + Russia + the USA has been on a real five year tear since early 2009. But the combined growth in C+C production has slowed in the last ten months or so. And, I believe, it will peak next year and turn down rather significantly in 2016. Meanwhile the rest of the world….

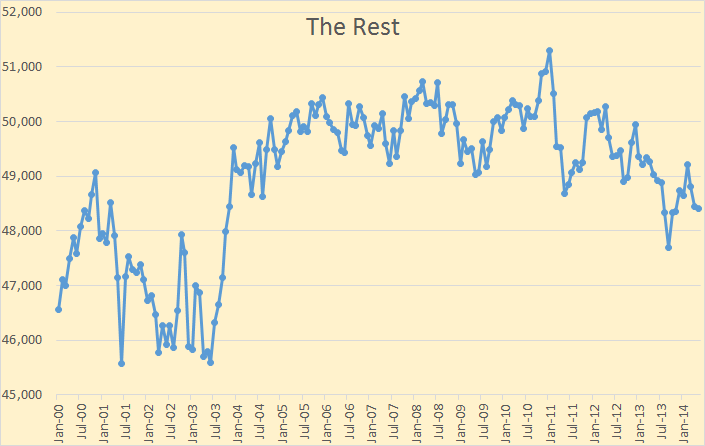

This is a graph of World oil production less Saudi, Russia and the USA. World less these three top producers peaked at 51,292,000 barrels per day and have dropped by 2,884,000 barrels per day in the 40 months since that date.

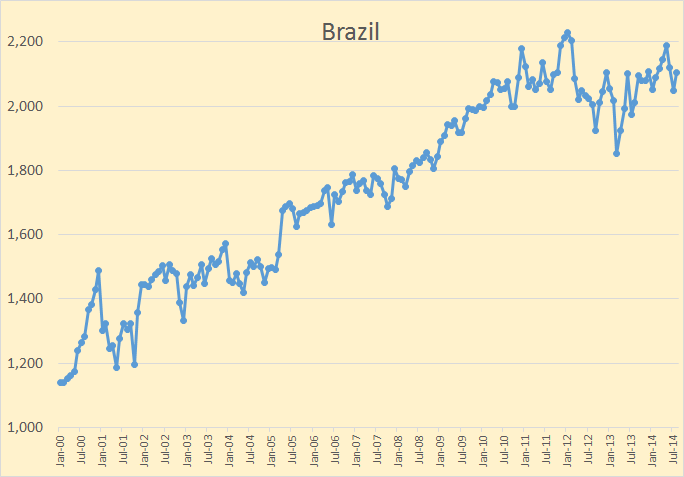

In other news there is Brazil: Petrobras Monthly Update: August Oil and Gas Production From Brazil Rises By 2.9% Over July.

Its domestic crude oil production grew by 2.7% from 2,049 thousand barrels per day in July to 2,105 MBD last month.

I have used the above figures to update my Brazil chart through August. (Assuming their numbers are C+C and not crude only.)

But in other news things don’t look so rosy for Brazil.

Brazil “falling off the world oil map” over failed policies

RIO DE JANEIRO – Investors are losing interest in Brazil’s oil industry as the country’s energy policies raise costs, reduce efficiency and increase risk, Brazil’s oil industry association, the IBP, said on Monday.

Without changes Brazil will likely lose out to places such as Mexico, Iran, Iraq and Algeria where policies are becoming more open to private sector investment.

“I went to the three largest oil conventions in the world this year and you hardly heard Brazil’s name mentioned,” Milton Costa Filho, Executive Secretary of the IBP told reporters at an industry event in Rio de Janeiro.

“Brazil is falling off the world oil map.”

The pages Non-OPEC Charts and World Crude Oil Production by Geographical Area have been updated with the data for May 2014.

I send out an email to about the folks that wish to be notified whenever I publish a new post. If you would like to receive that notice then email me at DarwinianOne at Gmail.com

Thanks Ron! The trend continues!! Even if we keep finding resources, because of their complexity they will be coming on line at a slower rate than the past. That is enough to keep the decline going.

Hi Ron,

Nice update. I prefer the trailing 12 month moving average, which hasn’t peaked yet, but if the current trend continues, it will occur within a few months. Of course these trends change all the time.

Dennis, I have made no claim that crude oil has peaked, only that the current peak is February. I really don’t expect that peak to hold but I do believe the peak will be by 2015 and I am talking about the 12 month average peak of world oil production.

Hi Ron,

I think your call may be correct, it depends how fast the rest of the world declines and how quickly the current US increase slows down, I would guess as late as 2017 with my best guess around 2016, but 2015 is the earliest I would expect.

There are a lot of wild cards, how fast will oil prices rise, and how soon will the world economy collapse in response? Nobody knows of course.

Just out of curiosity, do you expect a noticeable decline by 2015 or do you think a short plateau (12 to 24 months with the 12 month moving average remaining within 2% of the 12 month peak) is a possibility?

I think I said “peak” by 2015 therefore I would not expect a noticeable decline at the same time. Plateau? No, I do not expect a plateau. A plateau has to be several years to be called a plateau. Level prices for about a year would just be called “The Peak”.

I expect production to be declining by 1% or more by 2016 and to pick up speed by 2017. Of course I could be a year or so off, but I doubt it.

No way we get a plateau. Shale alone is barely capable of plateauing. That stacked on everyone else declining? Forget about it. The scenario implied by that is Saudi + whoever expands production by at least as much as everyone else is declining. Russia sure won’t. Kazakhstan will be lucky to fix its engineering issues by 2016.

Iran is a one-off shot in the arm. Iraq is, well, Iraq.

I just don’t see how plateau works.

Once a peak is reached, prices will rise and after a delay (because it takes a couple of years to bring projects online) some previously marginal developments may be brought online, this could result in a short 1 to 2 year plateau, though Ron would not call this a plateau because he defines it differently, which is fine.

I was just trying to see what Ron meant by a 2015 peak, because it is hard to define a peak without a decline (otherwise we would just have a plateau.

Hirsch as defined a plateau as remaining within 4% of the peak.

If we assume a plateau that wanders up and down (like the 2005 to 2008 period) we might use +/- 2% of the average output over the plateau period. If decline is only 1% per year for a couple of years, then we could see a plateau that lasts for 5 years.

The average C+C world output from Jan 2012 to May 2014 has been about 76 Mb/d, 2% of this is 1.5 Mb/d so we could define a 74.5 to 77.5 Mb/d window for a plateau, currently the 12 month average is about 76.4 Mb/d and a 1% decline for 2 years would get us to 75 Mb/d with a plateau ( by Hirsch’s definition) that lasts about 4.5 years.

The big unknown is how fast oil prices will rise (in 2005 to 2008 oil prices rose by 19.8% per year as measured by annual average real oil price change from 2004 to 2008 from the EIA real prices viewer, over the 2003 to 2008 period oil prices rose by 21.8% per year.)

The economy might be able to muddle along with a real oil price rise of 10% per year for a couple of years, but a big jump like the 2003 to 2005 oil price increase of 24% per year will likely lead to a recession.

Dennis, if production falls at 1 to 2% per year for a couple of years and then goes back up to the previous level in the next couple of years then that is a plateau, a bumpy plateau if you will.

However if production falls at 1 to 2% per year and keeps that up for many years then that is definitely a peak not a plateau. A “bumpy plateau” requires bumps. A peak is the point of maximum production. It doesn’t matter what happens after that if production never reaches that point again. You can have bumps after the peak but the peak is still the peak.

I am predicting the peak of C+C in 2015, give or take one year. I do not expect there to be a bumpy plateau. However where I differ from your opinion, and also the opinion of many others in the peak oil field, I think, is not in the date of the peak or the plateau, it is about the price of oil.

You, and many others, expect the price of oil to rise as production drops. I expect that to happen at first, but not to rise very far before it affects the economy and drives prices right back down again. Prices may spike, like they did in 2008, but they will never average, for one full year, more than $125 a barrel in 2014 dollars.

I understand where you are coming from. You think we will adjust. You believe, if I understand you correctly, that as prices rise to $150 a barrel we will adjust. Then as they rise to $200 a barrel we will adjust again. It is my humble opinion that this is impossible. Sure some segments of the economy can adjust to higher and higher prices. But the economy as a whole cannot.

The economy is already very sick. And the high price of oil is one very significant contributor to that sickness. Not the only one mind you, but a very significant one. The mounting debt is perhaps the primary contributor to the sickness of the economy but then the high price of oil is perhaps the most significant contributor to the mounting debt problem.

Anyway I hope you get the gist of my argument.

I agree with you that the prices won’t rise much even if the juice runs out. It would be better if it would, but it won’t.

I think higher prices may or may not result in higher “production”. Depends on geology and technology, not just demand curves. But demand helps.

Having paid $8-10 a gallon for more than 10 years, I am not as worried as you are about shortages.

I think your claims that there is something wrong with the economy are borderline crazy, sorry to say it.

Hi Ilambiquated,

I agree with Ron’s analysis in general, that when real oil prices reach some higher level that a recession is likely and that this will reduce prices and oil output.

I disagree with his assessment of the particular price where this will occur.

If we use IMF World outlook World GDP data and assume that Hamilton’s analysis applies to the world (rather than just the United States where liquid energy use per unit of real GDP, based on PPP method of comparison, is higher than the World average), real oil prices could rise to $150/barrel in 2013 US$.

This would allow real oil prices to rise by 5%/year from 2014 to 2016 and 10% per year from 2017 to 2019. World GDP grew at 3.5% per year (PPP method) from 2005 to 2013 while World C+C output grew at only 0.4% per year over the same period. I assume that 0% growth in C+C will lead to 3.1% growth in World GDP and a 1% decline in C+C results in 2.1% World GDP growth. I also assume no growth in C+C output in 2014 and 2015 and a 1% decline in C+C output from 2016 to 2019. World spending on C+C remains below 4% of World GDP through 2018 in this scenario and real oil prices are at $140/barrel (2013US$), if real oil prices rise above $150/b in 2019, then recession hits (assuming that Hamilton’s analysis can correctly be applied to the World).

Note that Ron expects the decline rate to accelerate quickly, but my World Oil Shock model suggests decline rates will be relatively modest until recession hits.

I will post a chart with the World Shock Model and decline rates further down the thread so the chart is readable.

Note that Ron expects the decline rate to accelerate quickly, but my World Oil Shock model suggests decline rates will be relatively modest until recession hits.

Ahh but that means we could both be right. Recession will very likely hit a lot sooner than you seem to believe. We are on the very cusp of recession right now. $125 oil could very well be the trigger that flips us into a recession, perhaps with all the other problems we have, a deep recession. Low demand will cause both prices and production to drop a lot faster than you expect.

Hi Ron,

As I attempted to argue, Hamilton showed spending on oil above about 4% results in recession. The US oil consumption per unit of GDP is slightly higher than the World average, so assuming this 4% Hamilton estimate for the World is conservative.

Using the rates of change of World C+C output and World GDP over the 2005 to 2013 period suggests a 3.1% increase in World GDP if C+C output is flat and a 2.1% increase in World GDP at a 1% decline in World C+C output. World GDP was 87 trillion using the purchasing power parity (PPP) method of estimation (which most economists agree is the best measure).

I will let you do the math, but a 1% C+C decline rate suggests the recession would hit in 2019 if prices rise above $150/b (2013US$). That analysis assumed 1%/year decline in C+C output from 2016 to 2019, that estimate is conservative, the decline rate will be slightly lower than that (0.7 to 0.8%).

You may still be correct that the recession will hit sooner, but Hamilton’s analysis applied to the World suggests otherwise. Since 2005 the World economy has been growing at an average rate of 3.5% per year, I predict that this will slow to 3.1% and then to 2.1%, Hamilton’s analysis suggests recession in 2019 if real oil prices breach 150/b by 2019.

That chart referred to a couple of comments up can be found at the link below:

http://peakoilbarrel.com/world-oil-production/comment-page-1/#comment-246155

But on a finite map, where are projects that are both materially large, not economical to exploit at current levels, and can actually be brought to significant capacity in 12-36 months? Not tapped, but up and running enough to matter.

The 12-36 months part: that’s easy. Infill drilling in existing reservoirs.

Hi Doug,

🙁

you forgot the smiley face ” 🙂 ” which can be done with the colon or semi-colon and right parenthesis (or left for a sad face) surrounded by spaces. That is, you should leave the quotation marks out in the example above. 😉

Anon: I completely agree with you! Latest Bakken monthly report says Bakken oil is selling for $75. There is minimal incentive to spend capex to earn $75/barrel. On top of that July North Dakota production grew just 18k b/d or 1.7%, down from an increase of $52k or a 5% increase the prior month. July should have been a good month as their are minimal cold weather excuses in summer.

Hi Coolreit,

The 75/b is at the wellhead, at the refinery gate the price is $87. The current average North Dakota Bakken/Three Forks well breaks even at about $60/b at the well head assuming a 10% annual discount rate (used to find the net present value of future income from future output).

When they run out of room in the sweet spots, and the average new well EUR decreases as a result, then these low prices will be an issue.

Dennis, there is already a lot of drilling outside the sweet spots. The current price of oil is already a huge problem in those areas.

Several things are happening.

1. To maintain current production more and more drilling must be done in areas of less and less production per well.

2. Downspacing is already reducing the “oil per well” production in the sweet spots.

3. The cost of production is rising. I have seen figures as high as 10% per year. Bernstein, (below) says it is even higher.

4. Gas capture regulations will limit profitability in areas outside the sweet spots.

Costs rise for ‘technological barrels’ of oil

US shale oil is increasing the marginal cost of production

Sanford C. Bernstein, the Wall Street research company, calls the rapid increase in production costs “the dark side of the golden age of shale”. In a recent analysis, it estimates that non-Opec marginal cost of production rose last year (2012) to $104.5 a barrel, up more than 13 per cent from $92.3 a barrel in 2011.

Hi Ron,

I have pointed this out before, but will try again. There is a lot of variability between wells in the Bakken, but what is important is the expected average output of any oil company’s wells that they are developing.

Not every well will be a great performer, though you would never know that by reading investor presentations.

As I stated earlier, when the average new well EUR starts to decline, low prices will cause the drilling to slow down, at the 2013 level of new well EUR, the breakeven price at the wellhead is $60/barrel, for the three forks wells (which have a lower new well EUR) the breakeven price is somewhat higher, about $66/barrel at the wellhead.

Keep in mind that no company plans to drill a poorly performing well, in fact every company plans on drilling above average wells 🙂 It doesn’t usually work out that way, some wells are way better than average and some are way worse, it’s the nature of the game.

The low prices will definitely hurt things if they continue. It may be that the Bakken shipments to the coasts are as large as the transportation infrastructure will allow and that may be depressing prices.

Wait, what?

“It may be that the Bakken shipments to the coasts are as large as the transportation infrastructure will allow and that may be depressing prices.”

So restricted supply pushes price down?

So restricted supply pushes price down?

No, no, it’s oversupply at the rail head that pushes the price down. That is a possibility.

Says the shipments can’t get larger and that lowers price. Makes no sense.

Where did that 87 number come from? The variance in the oil is huge.

Anonymous,

If there is not capacity to transport all the oil, it get’s stranded at the wellhead and the price at the well head goes down.

For example if it costs $12/b to get the oil to a coastal refinery by rail, but it costs $24/barrel to get it to the refinery by truck, then if you have not contracted space on the train and have to use a truck to transport to the refinery then your oil sold at the well head would be priced $12 lower to account for the increased transport cost.

Transport cost to east coast refineries is $12/b by rail, so if the wellhead price is $75, the refinery gate price is 75+12=87.

Note that this oil competes with Brent at east cost refineries which is about $96 per barrel, so I would expect the wellhead price should be $84/b. The fact that it is $9/b less indicates a transport problem or that the price to transport the oil has risen to $21/b. Such a price increase would be expected if rail capacity was in short supply, the rail companies may be charging more for shipping.

Oil popping up today. I don’t think people have been adequately focused on what it means to have 100K bpd flowing and billed at $40/barrel. ISIS may have been all that took the price down $15.

I like Matt’s chart on the world less US. When we do a trailing 12 month moving average the world less US peaked in Sept 2012 and declined at a little less than 1% per year from Sept 2012 to May 2014. Hard to know if the levelling off of this decline since Dec 2013 will continue, probably not for long.

Hi All,

Often in the main stream media they talk about all liquids rather than crude plus condensate. Using BP Data in tonnes and then dividing by 7.33 barrels/tonne allows rough conversion to barrels of oil equivalent where the barrels have similar energy content. The chart below uses BP consumption data for all liquids and BP production data for C+C+NGL in millions of barrels of oil equivalent per day (Mboe/d). Over the 1997 to 2013 period the average rate of increase in all liquids has been 1.2% and for C+C+NGL the rate of increase has been just under 1.1%. EIA C+C data is also shown for comparison, the rise in C+C output over the 1997 to 2013 time period was 0.9% per year.

The peak in all liquids will likely be a few years after C+C, maybe 2018, though oil prices will be key and these are difficult to predict.

“where the barrels have similar energy content”

But they do not. As you well know, NGL’s and ethanol both come in at around 70% equivalent EC to crude… And a growing percentage of ‘all liquids’ is comprised of NGL’s, in particular.

Hi climan

I use mass and then convert all to barrels. Energy content by mass is pretty close to the same for ngl crude etc

Ron, this may be the last time I post from the UK. Brazil may have production problems. Our’s are much more serious. I think the most extreme view takes us towards Scotland having more oil than has ever been produced in the world. For those interested there are some very well informed comments, obviously from industry folks. And links at the end to other posts I’ve had on this fundamentally important issue.

For A Few Trillion Barrels More

For those not following, Scotland votes on Thursday on whether or not to stay in the UK. The polls are very finely balanced 50:50.

Hi Euan,

Is the discovery data backdated?

Dennis, I don’t know. But we are looking at numbers of fields here, not discovered volumes. The date is the discovery well.

Hi Euan,

Sorry, I should have looked at the chart more carefully.

Is the discovered volume data available, it seems(to me) that it would be more relevant?

Last year, I believe that the average Bakken well produced a little over 100 bpd, and the median Bakken well produced a little less than 100 bpd. I wonder what oil price would be necessary to support offshore production from these type of wells in a region like the North Sea?

Jeffery, One of the back of envelope analogies I used is that 13 steel jacket platforms would be required to develop an unconventional resource that could be developed using a single steel jacket for a conventional resource. So maybe *13 is a god starting point.

That clay may bend, not frack.

Yes in comments I make the point tha the Kim Clay is more like plasticine. But the reality here on the ground is that Nationalist politicians love these numbers

How ductile or brittle the clay is depends on its species. The other issue with high volume clay rocks is their tendency to swell in the presence of water, which makes holding fractures opened difficult.

Must not be any water down there then. I was wondering what happens if you get large amounts of contaminated production water from shale wells off shore. Do you just dump it in the ocean?

On your first part, there is water where the shales are, there is just volumes equivalent to the pore volumes that exist in the rock. When you far exceed that pore volume with water the clay will swell and absorb the extra, depending on its species. Remember, the porosity and permeability of shales is extremely low, so water does not flow easily through them without fractures, either artificial or natural (large amounts of water wont contact all of the clay without help). That’s what has always confused me about the pad drilling where 8 wells go in all directions. Half of them are going to be oriented parallel to preferential permeability, which should make them underperform.

As far as water handling offshore, I have no direct experience. However, I doubt they simply dump it. The drilling mud they use could also be considered contaminated, since it ends up taking some of the heavies and radioactives back to surface, but I doubt it is simply pumped out into the water (that might be legal, I don’t know). I’m sure there are regulations dealing with the disposal of waste from drilling operations offshore somewhere.

Sea going trucks to haul oil and waste water from 600 bpd wells. Hard to see how that works.

The Scots are smoking dope. No one reverses that kind of decline.

Anon is probably right but the Brits apparently lied about the oil reserves the last time the independence question came up and so lack credibility this time.

Beyond that people mostly believe what they want to believe and there is not much that can be done about that other than to just wait and let them see for themselves what the truth is.

Much is made of the notion of ‘economically recoverable’ petroleum (or analogs) without understanding that in real terms, ALL industrial activities are incapable of paying their own way, NO industrial enterprise is by itself economically ‘feasible’; ALL industrial enterprises are dependent upon a continual debt subsidy. Industrial activity here includes drilling for oil.

The definition of ‘feasible’ is flexible. Drilling relatively shallow vertical wells in conventional, dry land fields cost less than drilling and completing ultra-deep horizontal wells particularly offshore. Every drilling effort is inherently ‘underwater’ (debt-dependent) but the high-tech fracking projects are much more so by an order of magnitude. More drilling = more debt; the cost of credit must be added to the actual drilling costs; at some point the service on ballooning aggregated debt cannot be met with new loans … this is your ‘Minsky Moment’.

– That this moment is already underway as can be seen in world oil prices: fall-off in the availability of credit => insolvency of borrowers => less of a bid for oil cargoes. This is a component of the longer-term trend from 2008 of (diminishing) high crude prices periodically rendering customers insolvent (oil mini-shocks).

– Governments-central banks are subsidizing drillers with zero-percent interest rates (ZIRP), contrived stock- and bond market ‘bubbles’, the issuance- and forced purchase of ‘high-yield’ (junk) financing along with favorable government treatment of oil drillers (leases, tax advantages, depletion, etc). In other words, credit expansion and asset price increases serve the interests of the petroleum industry, it also has governments as borrowers-slash-subsidizers of last resort => scraping the bottom of the energy barrel.

– China/Japan/EU/Russia/Brazil recessions due to diminished credit flows and failed/stupid policies. Recession = adverse affect on credit due to the inability to market collateral or raise loans to retire those that are maturing.

I made a similar point on the prior thread, to-wit, it seems to me that central banks are in effect are partially funding both sides of the war, i.e., supporting demand (via QE support for public debt) and supply (via low interest rates). An interesting chart would be total global public debt + total global oil and gas company debt, from 2002 to 2013.

By definition, as we have seen a massive debt buildup, we have depleted the remaining post-2005 supply of global crude oil reserves and the remaining post-2005 supply of Global CNE (Cumulative Net Exports), the only question would be the respective rates of depletion.

But see, guys, that hides reality behind complex phrasing.

Reality is money doesn’t matter. If you HAVE to have the oil, you create money to get it and pretty much just hope everyone believes the money means something.

This is why a voluntary shut in event “to save it for our grandchildren” will be such a global earthquake. It will make clear the people in question don’t care what you’re willing to pay for it.

I wonder why OPEC has acted to reduce oil production cause low prices.

The OPEC countries are not the ones with the conventional wells at greater profit margin? Instinctively, I would say that other countries should reduce output having margins are too low. …

Only one or two OPEC countries will actually reduce production. The rest of them will just lie about doing so.

The ones that can and will do it are usually Saudi Arabia and the UAE. They can afford to do it.

All the other oil exporting country are in too bad a spot for money to cut back. They are all compelled to sell every drop they can as fast as they can to get their hands on the money..

Quote of the day, well it was actually made on June 30th.

Right now, the citizens of the planet are more than 223 trillion dollars in debt, and “too big to fail” banks around the world have at least 700 trillion dollars of exposure to derivatives.

So it doesn’t really matter too much whether the short-term economic numbers go up a little bit or down a little bit right now. The whole system is an inherently flawed Ponzi scheme that will inevitably collapse under its own weight.

Let us hope that this period of relative stability lasts for a while longer. It is a good thing to have time to prepare. But you would have to be absolutely insane to think that the biggest debt bubble in the history of the world is never going to burst.

18 Signs That The Global Economic Crisis Is Accelerating As We Enter The Last Half Of 2014

The level of desperation and the magnitude of measures already taken are deeply hidden by sheer complexity.

If there is trillions in debt and that debt threatens systemic collapse, just expunge the debt. The debt holders can be killed, literally, or figuratively. This has already happened. It’s not new. It happened in Greece in 2011. The global system was at risk. The holders of Greek debt were ordered to accept a change of maturity and essentially lose all their money AND they were forbidden to declare that a default. Consequence? Cyprus a year or so later. They were big holders of that debt. The EU managed to make it look like Cyprus was irresponsible.

But nobody starved in Cyprus. You just expunge the debt. It doesn’t have to mean anything. It’s just an artificial concept — money, that is. It’s a substance invented by man. It doesn’t exist in nature. You can change its meaning at will.

Are you seriously claiming that the debt problem could be solved by just declaring all debts forgiven, and all debtors are just shit out of luck? That the US Government declare the national debt null and all bondholders are just SOL? All public debt null therefore all mortgages were no longer valid and the banks left holding useless paper while the borrowers then owed nothing?

Would people keep driving their cars while the car dealers went out of business, and people stayed in their homes while the banks all went bust. That might work fine for awhile but there would be no more cars made because only a tiny few could afford to pay cash. And no more houses built for the same reason. The manufacture of all expensive items, cars, trucks, boats, homes, large appliances and such would stop immediately because there would be no borrowing.

Farmers could not produce crops because they could not borrow. Drillers could not drill wells because they could not borrow. All construction would stop because all construction is done with borrowed money.

Debt is not an artificial concept. It is the very backbone of the economy. And what applies to a tiny country, population wise, could not be applied to the entire world. A nullification of all debt would mean half the employed population would be out of work next week, and the other half out of work next month.

Yes, notwithstanding the massive economic destruction that would ensue (it would be EPIC!!!), it could, nonetheless be done.

In fact, it kinda happens all the time in bankruptcy courts where creditors take a haircut. It’s just that this time, all creditors would be scalped. Emergent effects from such a massive undertaking would no doubt arise.

I would note though that we’d almost end up in the same place if everyone stopped spending all but the bare minimum and actively worked to pay off the debt ASAP. Could you imagine the economic shockwaves from no one engaged in discretionary spending? That would be devastating. Not as devastating as everyone’s debts being nullified to be sure, but orders of magnitude worse than the Great Recession.

Which is, when you think about it, a really kind of weird system. The system would be near collapse if people actually paid their debts without taking on new debt.

So it goes.

World Graphic of Oil Flow by Nation.

http://www.businessinsider.com/r-exclusive-us-considering-options-if-oil-export-ban-challenged—sources-2014-9

Those in Washington will now to work some magic and just fix it till the US turns Green. Good to know they are on top if it…. /sarc

What you are describing is how debt default or pay down in one country would work. Extended to the whole world, the effect would be that those surplus countries that have been induced to run surpluses and used foreign debt as a store of value will realize they have been had. Not wanting to get burned twice they will be reluctant to run surpluses in the future unless forced. In other words, trade balances will matter.

Ron said:” Are you seriously claiming that the debt problem could be solved by just declaring all debts forgiven, and all debtors are just shit out of luck? That the US Government declare the national debt null and all bondholders are just SOL?”

Thing is – hasn’t the Federal reserve become by far the biggest buyer of US government debt? Hasn’t the BoE been doing the same thing with UK gilts? Now I am just purely being hypothetical here, but surely therefor isn’t the mechanism for substantial government debt cancellation being put in place? Your central bank just buys all the latest government debt and then at some point in the future just cancels it?

The Fed buying debt is a slow motion default. It raises bond prices in the near term but sets up negative real rates of return over the long term. So without force, who wants to keep adding to assets that offer a negative real rate of return?

Exactly. So ‘foreign’ non-government/central bank holders of debt gradually sell out, the respective ‘home’ central banks gradually accumulate this debt too, and then somewhere down the line they cancel this as well. Or the respective central banks (Fed, BoE, ECB) act in concert to cancel cross holdings. Is this not the sort of thing Keene was alluding to in his ‘jubilee’ hypothesis?

So then what do the foreign holders of all the debt do with the trillions of dollars they are paid by the Fed? Park it in a bank at negative real rates and take the chance of losing it all or investing in over priced real assets that currently offer a poor risk return ratio? Domestically, where are the retirement and insurance funds supposed to go for a real return on investment?

Central bank buying has set the stage for negative real rates of return for a long period of time.

It’s not the same thing Andy. What about the bonds the Chinese, Japanese and everyone else holds? What about all those retirement funds? Retirement funds disappear overnight and seniors depending on them starve.

And that was not all, the proposition was all debts would be cancelled. No one pays a mortgage or car loan or credit card debt. The economy runs on borrowed money and without borrowed money the economy collapses. That was the point, not how the government prints money.

Perhaps I didn’t phrase it right – but a slow motion default (via debt cancellation) is what I was getting at. If we just look at the US – My understanding is that in recent times the Fed has been buying the vast majority of US debt. As you quite rightly say, there are other diners at that table (foreign banks, investment funds, pension funds) – and as you say a cancellation of the US debt they hold kills them. But what if it is not done like that – instead it takes place over 5-10, however many years. The Fed crowds all new buyers of US govt debt out (something I believe they have been doing for several years now) and then gradually accrues (over years again) all the debt held by external bodies (pension funds etc), either as the debt matures, or by direct purchase. That way they are not discomforted, and the Fed goes on its merry way, endlessly buying and cancelling debt (this of course brings with it huge issues of currency debasement etc but then when have central banks been too concerned about that?). Anyway just some random musings….

Woody – I totally agree this sort of financial engineering brings huge problems (where do you go to get yield?) and I think it is shocking if it has indeed come to this. But the Central banks are there to keep at least some semblance of the system going, and if this is the only way open to them I can see them going down that avenue. After all their is that old saying ‘Debt that can’t be repaid, won’t be repaid’.

Hey, don’t get me wrong. I believe the system is going to collapse. But I just don’t think we should force that collapse… overnight… by cancelling all debts.

“Retirement funds disappear overnight and seniors depending on them starve.”

If retirement funds disappear, that does not mean that food disappears too. They only starve if the state lets them starve, and food security is the primary purpose of state administration. That’s why Hitler had no problem in restarting the German economy in the 1930, because the real economy did not disappear with the financial crisis, all of it was still there, all the resources and productive capital. You just need a dictatorship to manage and redistribute it anew.

real economy did not disappear with the financial crisis, all of it was still there, all the resources and productive capital.

Well hell, now you are catching on. If the productive capital disappears then the system crashes. If lenders lose all their capital there is no more lending, no more mortgages, no more cars, no more construction, no more economy.

That’s also how Roosevelt rebooted the American economy. Why are Americans so in love with Hitler? It’s weird.

Be that as it may, it is a conscious choice you make. For example, there has been a lot of squealing (including around here) in America about increasing the money supply despite the fact that trillions disappeared just a few years ago.

Another episode worth remembering is the Irish potato famine of 1848. The British government refused to send aid because it would be bad for the Irish economy if they did, and it would encourage laziness as well. Millions died.

Have you read “This Time Is Different: Eight Centuries of Financial Folly”??

You’ll find that countries go bankrupt, and sovereign debt goes unpaid, all of the time.

Have you looked at the book?

No, I have not read the book and it does not happen all the time. The only time it almost happened, in modern times, was in Argentina but even there the debt was actually restructured. And that was government debt. No private debts were forgiven. Many were defaulted, as they are often even in the USA, but they were not forgiven.

Argentine debt restructuring

Argentina began a process of debt restructuring on January 14, 2005, that allowed it to resume payment on the majority of the USD82 billion in sovereign bonds that defaulted in 2002 at the depth of the worst economic crisis in the country’s history. A second debt restructuring in 2010 brought the percentage of bonds out of default to 93%, though ongoing disputes with holdouts remained. Bondholders who participated in the restructuring, accepted repayments of around 30% of face value and deferred payment terms, and began to be paid punctually; the value of their bonds also began to rise. The remaining 7% of bondholders later won the right to be repaid in full.

Ron,

I’m not suggesting a “jubilee”, or program of large-scale debt cancellation. I agree that this would cause a depression. Heck, just losing Lehman Brothers caused a Great Recession. But, there is another point here:

Sovereign defaults happen all the time – please note that includes restructurings: any time the terms of a debt are involuntairly changed to the detriment of the lender, that’s a partial default. Argentina defaulted. So did Greece. Heck, Greece has been defaulting roughly every 25 years, for the last 200 years! All of the major European powers has defaulted in the last 200 years. That’s why US debt is so golden – it has an unprecedented history of never defaulting (the Continental Congress doesn’t count – it was before our current Constitution, and is really considered a different “country”).

Again, I agree that a US default, or defaults by major banks like Chase or Bank of America, would cause a major depression. I don’t think such a default is likely any time soon, but if it were to happen, it wouldn’t be the end of the world as we know it – things would eventually recover. Defaults of world reserve currencies have happened before – we know how it played out.

Really, you should read at least part of the book – you can’t talk intelligently about these issues otherwise.

“Are you seriously claiming that the debt problem could be solved by just declaring all debts forgiven, and all debtors are just shit out of luck?”

Yes, exactly. That’s what the first proper economies on this planet discovered very soon and practiced succesfully for millenia:

http://cadtm.org/The-Long-Tradition-of-Debt

http://www.washingtonsblog.com/2011/07/we-have-forgotten-what-the-ancient-sumerians-and-babylonians-the-early-jews-and-christians-the-founding-fathers-and-even-napoleon-bonaparte-knew-about-money.html

Strummer, both your links are totally unrelated to the whole world economy. The first, third world debt owed to first world countries. Yes that could happen without too much harm because third world is but a tiny fraction of total world dept.

Your second link, about the ancient world where they occasionally had a “Debt Jubilee” would be impossible in today’s world. In those days debt was only a tiny fraction of the total economy. Today the entire economies of all first world nations are based on debt.

For God’s sake, sit down for a minute and think about it. All banks would go bust. Because of fractional banking they have far more money loaned out than they have on deposit in their vaults. All banks in the world would have a run on their deposits. They could give depositors only a tiny fraction of their money back.

There could be no further loans for anything. All the world’s economies would crash… immediately.

Again, the ancient world was simple compared to the complexities of today’s world. You cannot use 200 BC economics to solve 21st century problems.

“Today the entire economies of all first world nations are based on debt. ”

Nope, they are not. They are based on food, tools and energy. Just like 6000 years ago. Debt is an abstraction of the value of those things, nothing more. Also, above I mentioned “productive capital” and you misunderstood is as money, saying it would disappear. That’s not what I meant. “Productive capital” is farmland, coal mines, factories, power stations, every single tool that can be put to use to produce added value. Those things do not disappear in the event of a financial crash. You only need to allocate them properly, as Hitler (and of course FDR too) did back then.

Yes they are. It takes money to buy food. It takes money to buy tools. It takes money to produce and buy energy. The world could not possibly be run on the barter system as it was run 6000 years ago.

6000 years ago people were either farmers or hunter-gatherers. They had no need for money and the economy of one group or tribe was totally separated from the economy of their neighbors… except when they were fighting each other of course.

We live in a capitalist world where capital is everything. So let me put it another way.

A capitalist economy is based on capital. Capital (money) is created by debt.

Actually capital is created by savings. That is the key difference between modern so-called “consumerist” societies and hunter gatherers — we save much more.

Capital is what is left over after the basic needs of a society have been satisfied. Or you could substitute “individual” or “corporation” for society. Capital is money to spend not money to save. If you save it it is not capital. It becomes capital only when you use it.

Well, yes and no.

What money does is more than just provide a means of exchange. It provides security for your value: it is protected by the legal and military systems in place in your country.

It is an agreement on what your labour and assets are worth, a protection on your ownership or holding rights of both cash and property, and through things like various boards of health, the EPA, and right on down to things like the SAE, assurance of the value and efficacy of everything from cars to flu shots. None of us can check every bolt and weld on our cars, or do our own checks on tetanus vaccines. Money allows us to believe (sometimes wrongly, I know) that competent systems are in place, and when the systems fail, to sue for redress.

Make no mistake: I think that the system is gamed. There is a reason the 1% have all the money, and it’s not because god wanted them to have it or that they worked harder.

But it’s the fault of the players, not of the game.

-Lloyd

Wow, look what I did.

But before macro-ing out a sweeping perspective about What Would Happen, I urge folks to go back and look at PRECISELY what was done with Greece.

People who were owed money by Greece Did Not Get Paid On Time. At all. The EU waltzed in and informed all those debt holders that they would agree to be eviscerated and under no circumstances would they declare default when it happened, because that would trigger CDS.

So yeah, ask yourself, what about all those Greek retirement funds. What happened to them? Total, epic destruction. But we never really heard much about that, did we? All we hear is about how the EU and IMF has agreed to send another tranche to Greece.

As for those folks with money in Cyprus banks who held Greek debt, they got smashed, too, unless they were Russians, who managed to get their money out the weekend prior.

But to be fair, in economic terms Greece is a flea. They did what they did to Greece because they knew Greece didn’t matter in their great scheme of things.

I am not sure why people are so excited about Greece, I guess it is Rupert Murdoch conspiring (yeah I went there) with the City (of London) to save the lucrative pound/euro arbitrage business, and creating a meme as a side effect.

Greece only owed people money because the Greek government offered guarantees to private Greek banks that went broke. The guarantees were there to provide security to Greek savers. The banks abused this security to buy worthless CDRs. Worse, there was a general run on all European banks after a minor German bank died. This run was caused by the stupidity on Wall Street, which is driven by skewed incentives — high rewards and low risks.

TLDR There are no cosmic forces at work here, and few lessons to be learned except let’s try not to scrfew things up quite so badly next time.

You guys aren’t calibrated on swaps. Greece is a flea, but flea size doesn’t matter in the credit default swap derivative market.

THAT was the concern. There is claimed to NOW be some measure of international regulation on swaps, but there wasn’t during Lehman (it was the swaps that smashed the world, they were just too complex for reporters to understand and talk about). And there wasn’t for Greece and the alleged control now probably is worthless still.

Look, quick layout. Joe lends Bill $1 million at 4% interest. Bill says I’ll pay it back in 5 yrs and starts making payments. But Tom, completely uninvolved in the whole thing, decides he wants to make some money so he offers to underwrite an insurance policy on the debt. If Bill defaults before complete payback, Tom’s insurance policy would pay the policy holder $X dollars. So Jim buys that policy thinking that Bill is going to default and he pays Tom an insurance policy premium.

There can be thousands or millions of Toms and Jims out there essentially placing bets on someone else paying off debt. That $1 million loan could have TRILLIONS of dollars hanging on it being paid. Half the parties are slashing Bill’s tires so he can’t go to work and half the parties are trying to give Bill the money to make payments.

That’s what credit default swaps are. That’s what can threaten the entire global system at any moment in time. And so, no one is allowed to default. Too risky when you don’t know if that loan is swapped to the stratosphere.

Left out a relevant part. It’s a swap of risk. A tool of risk management. A legal contract. The risk of credit default is swapped to another party.

So given that there exists a tool to adjust the risk of default, the interest rate on the loan no longer is the only measure of that risk. Welcome to yet another reason rates have fallen.

“But with Asia thirsty for oil to satisfy fuel and petrochemical demand, and Europe anxious to diversify supplies away from Russia, other countries are urging the United States to practice what it has preached for decades: free trade.”

Read more: http://www.businessinsider.com/r-exclusive-us-considering-options-if-oil-export-ban-challenged—sources-2014-9#ixzz3DbJNexPN

Asia bombed the US with Cheap Solar Panels. Our response should clearly to bomb Asia with our “surplus” cheap oil. We have a Solar Panel trade war(s) going on, what needed is oil war(s) .. wait a minute..

So the US alone imports the equivalent of all of Saudi Arabian export and most of the Russian export. Need a little belt tightening?

Good article about Scotland & oil by Kopits

http://www.prienga.com/blog/2014/9/16/fk6ouox1xgg5vnfbaheixwudiim083

ND sets new production records, flaring concerns linger

Not unexpectedly, North Dakota’s oil and gas production set new records in July, but declining Bakken crude prices combined with concerns about meeting the state’s gas capture goals could jeopardize future increases…

Helms expressed concern about price of North Dakota sweet crude, which has fallen from just over $90 a barrel in June to its current price of less than $75 a barrel.

“That’s putting some pressure on industry, especially on the fringe areas around the outer edge of the Bakken,” he explained. “Those lower oil prices really press those economics pretty hard.”

I can’t see any reason why debt is theoretically necessary. What is necessary is a concentration of buying power in spots where it is needed. It requires a good bit of money to pay for a new house for instance but a new house could be sold owner financed if the owner has enough money himself.

A big infrastructure project could be paid for by selling ownership shares in it to people who at this time have their money in savings accounts and so forth.

But getting from the ” here ” debt based system to a ”there ” equity based system appears to be a near impossibility.

The beautiful and marvelous thing about debt is that it makes it possible for a person who saves to finance the consumption of a person who is consuming.

But there is no reason farmers must borrow money to operate their farms in principle. We have not borrowed any money to operate ours for many years.I just recently bought a neighbors place owner financed with zero participation by a bank or finance company or real estate agent.The man I bought it from bought it forty years ago the same way.

The total closing costs on a six figure loan came to well under a thousand dollars and the attorneys who drew up the deeds and note got most of that. The rest went to the county as a recording tax.

What the seller has done in essence is to lease me the property to do with as I please for the duration of the note. So long as I make the payments and pay the taxes it is mine. But miss a payment or two or three .. and he will call the attorney holding the deed of trust and it will be auctioned off to pay the balance.

This is still debt any way you slice it or dice it but it is not the sort of debt that requires a whole top heavy system of parasites collecting more profits easier than the people who do the actual work that directly provides goods and services.

It would be hard for me to raise enough cash to buy all new equipment but if the equipment company were possessed of the assets of banks then it could sell by leasing to own the equipment.

The one company specializing in wooden bedroom furniture in this part of the country that made it thru the recent crash did so handily by being one hundred percent debt free. This company has been paying cash for many years for everything it uses.

The owners philosophy is this paraphrasing his own words.

If the furniture business is worth being in it is worth keeping the profits in the business.

When other people are paying ware house rent he is stocking his inventory in his own warehouse.

IF owning a warehouse is worthwhile to a warehouse landlord then it should be even more worthwhile to a man who needs one since he will never have to pay increasing rents or higher rent to cover the fees charged by commercial real estate agents.

He could invest his profits in another company or real estate or whatever but if he did then … well then he would have to pay interest on borrowed money with all the strings and pitfalls that would put on him in managing his business.

IF a bank can be profitable and satisfied with for instance a five percent return on a loan then he thinks he should be satisfied with a five percent return on his money spending it to run his business.AND if he cannot earn enough to compete with companies operating on borrowed money.. then he will sell out.

So far he has bought out the almost new state of the art equipment purchased by at least three companies that went broke when business crashed on them in the recent mini depression.

And he bought it a fire sale prices.

But just because it can be done in principle doesn’t mean it can be done on an economy wide basis given our current situation.

If you are worried that debt might end the world, consider the following: Mao Zedong made it a habit every time he marched into a village to destroy all bank and property records in a big bonfire in the market square. This is one of the main things that gave him so much rural support. When the Communists took over in ’49, they absolved ALL rural debt at the stroke of a pen. It was the birth of modern China.

I find it strange that this blog, which peddles the hyper-materialistic theory that all economic growth is tied to oil production, can get so excited about something as ephemeral as debt. Humanity owes humanity a lot of money. Are you sure that is a problem? If we owed the Martians a lot of money I might start getting worried. But we owe it to ourselves.

“If you are worried that debt might end the world, consider the following: Mao Zedong made it a habit every time he marched into a village to destroy all bank and property records in a big bonfire in the market square. ”

This is a critical truth of the world of 1s and 0s in money. It used to be that sovereign debt could be expunged by defeating a country to whom you owed money and finding the relevant documents in their capital city and burning them.

But it’s all multinational now. There is no bankruptcy court for countries. There is no entity with the power to expunge sovereign debt. Argentina was recently declared in default, but the relevant debt holders aren’t going to pay any attention to that. They didn’t tear up their documents when the declaration was made.

They didn’t tear up documents in the early 2000s when Argentina ITSELF declared the default. The debt remained in the hands of the debt holders and they negotiated terms and have been getting paid since.

A country that doesn’t need to borrow more money can declare default with impunity. A country that needs to borrow more money can’t, because there won’t be any lenders.

Ilambiquated, the subject is all debt, not just government debt. You do not owe your mortgage payment to yourself. Ditto for your car payment. And the money the government owes is not all to us. The Chinese, the Japanese and a lot of other people are owed a chunk as well. And much is owed to corporations, pension funds and such.

The full faith and trust of the government is on those bonds, just like the money in your wallet and the money in all banks. If the full faith and credit of the USA is lost then everything else is lost also. Standing armies would not get paid, police would not get paid, no one would get paid anything. There would be only chaos and anarchy. Half the people in the USA and most of the world would be dead within a year. And over the next few years 90% of the rest of the world would be dead also.

It would be the end of civilization as we know it… total world collapse.

All debts are paid, if not by the debtor, then by the creditor.

Of course, in a hyper-inflationary environment, like the Weimar Republic, mortgages were paid off with money that would buy a few loaves of bread, but even in this case, in effect the creditor “paid” the debt, as they suffered the loss in purchasing power.

One man’s debt is another man’s asset.

I think the original point has been missed in the conversation.

Lemme go get my quote:

“If there is trillions in debt and that debt threatens systemic collapse, just expunge the debt. ”

Rather zero emphasis has been put on the “and that debt threatens systemic collapse” in the discussion and it was the whole point of all of the text.

This was why the EU destroyed the assets of those guys who held Greek debt via pseudo expungement. The situation threatened total global systemic collapse via swaps.

Now it HAS been suggested that swaps be outlawed — but they are legal contracts. Hard to outlaw contract law, and even harder to get one country’s legislation imposed on contracts in another country. Ask Argentina about that one. They borrowed money via bonds whose text clearly said New York state law. Now . . . they want to escape that text.

I’d recommend reading David Graeber’s book “Debt: The First 5000 Years” for a brilliant explanation of what debt really is. Debt is not going to collapse the global economy, because the real economy is not going to disappear magically when debts are cancelled.

Strummer, the economy is more than just debt but debt is a major part. What matters most is people’s ability to purchase goods and services. The economy is money, energy, labor, goods and services. All these things work together bur remove any one of them and the system breaks down. If people have no money they are helpless. If their money is worthless they are just as helpless.

If debt disappears and all debtors are left with nothing but losses then they will not lend any money. There can be no borrowing for homes, cars or anything else. People manufacturing and servicing these things will have no jobs. The economy crashes, more people are out of jobs and the economy sinks even deeper.

We do not live in such a very simple world as a lot of people seem to believe. Everything is connected. Remove any necessary ingredient from the system and the system crashes.

There is that.

There’s the real economy of goods and services. I.e. stuff.

Then there’s the flipside of the real economy, which is the money and financial system. All kinds of manipulations and obfuscations are possible here, but they are entirely reliant, ultimately, on the real economy. The financial system can blow up and cause real problems in the real economy (because payments don’t get made and so on). But some parts of the financial system are far removed and practically detached from the real world economy (e.g. credit default swaps to infinity).

The real world economy doesn’t work like that. If harvests fail, and there’s no grain on the market to be bought, people starve. If there’s no gasoline to be had because there’s no oil reaching refineries, our modern transportation network grinds to a halt (as we all well know) and people starve.

It takes a whole lot of disruption in financial system for people to starve, though it is possible (I suppose). So that’s what one, I think, one is wise to keep an eye on, in these discussions.

If financial systems collapse, hard times are definitely ahead, due to uncertainty and chaos, but I’m not entirely sure that starvation NECESSARILY results. Hardship yes, collapse of civilization, eh, not so sure about that.

However, if enough of the grain harvest is toasted by whatever, you can be certain that civilization will take a massive hit. People will starve. If the harvest collapses completely (in a manner equivalent to the financial system collapsing completely), essentially everyone will starve and collapse of civilization is pretty much certain (or at least far more certain than in the case of financial collapse).

I always find it odd / remarkable that we (i.e. government and the press, and by extension John Q. Public) expend a lot of energy and worry on financial matters, but no one worries a whole lot about crop failure (the very linchpin of civilization) or food supply issues (except maybe some eggheads in the agriculture faculties at universities and related government departments, but even they seem pretty quiet on the matter). Perhaps we’ve gotten too good at beating that particular Horseman such that we don’t seriously pay him any mind. It wasn’t always so. I guess this means it’s a great time to be alive, or at least in those countries where famine hasn’t been experienced in generations (the last large scale famine in North America was when exactly? Has one ever occurred ever on this continent since the Europeans arrived? If so, I don’t think I’ve ever really heard about it, except for the very first settlers who had some very hard and lean times). Even in Europe post WWII when the whole continent was shattered and wrecked, they didn’t suffer large scale famine (and that was the most precarious situation in that respect that Europe has seen in probably a century or more) though rations were pretty lean (I’m reading Postwar by Tony Judt so I’m reasonably confident about my facts here).

Can we have a financial collapse so bad that it’s the equivalent of WWII’s physical destructiveness in Europe? I suppose it’s possible, and the cancelling of all debts would have to be one of direst financial hits that the system could take, but I don’t know with any kind of certainty that it would really do the trick. The banks and various financial companies would be wiped out. The real world would operate less smoothly, and not at in some or many cases. But would everyone starve? Maybe. But I’m not seeing it as a certainty. I could well be seeing it wrong. Probably am. But even the Great Depression and Great Recession, financial calamities of the highest order didn’t lead to famine (so far as I’m aware), so I dunno.

The Summer of 1816

http://www.erh.noaa.gov/car/Newsletter/htm_format_articles/climate_corner/yearwithoutsummer_lf.htm

“It didn’t matter whether your farm was large or small.

It didn’t matter if you had a farm at all.

Cause everyone was affected when water didn’t run.

The snow and frost continued without the warming sun.

One day in June it got real hot and leaves began to show.

But after that it snowed again and wind and cold did blow.

The cows and horses had no grass, no grain to feed the chicks.

No hay to put aside that time, just dry and shriveled sticks.

The sheep were cold and hungry and many starved to death,

Still waiting for the warming sun to save their labored breath.

The kids were disappointed, no swimming, such a shame.

It was in 1816 that summer never came.” – Eileen Marguet

I had heard about this before and read that very quote before. I can’t say I recalled it when I wrote this. However, did large scale famine result?

From the link you provided: ” Orchard yields ranged from barren to moderate but enough grains, wheat, and potatoes were harvested to prevent a famine but hardships did occur.”

That said, if a similar event occurred today in North America, we’d import food from somewhere else. If such a thing happened worldwide, well, we’d have a few wars, some famines and other kinds of nastiness on our hands. I’m pretty sure North Americans wouldn’t starve though all the same. And yeah, I know that I could be wrong. But could you imagine it? Actual starvation or even food insecurity in North America? I can’t. The fact that the link you provided goes back 2 centuries (7 – 10 generations or so) shows just how incredibly odd the idea of widespread famine is to us.

It was worldwide, thanks to volcanic eruptions.

http://en.wikipedia.org/wiki/Year_Without_a_Summer

“Farther north, nearly 12 in (30 cm) of snow was observed in Quebec City in early June, with consequent additional loss of crops—most summer-growing plants have cell walls which rupture even in a mild frost. The result was regional malnutrition, starvation, and increased mortality.”

Could easily happen again.

>the subject is all debt, not just government debt

I agree. All this noise about government debt you read in the American press is just Republican code for screw the poor.

> And the money the government owes is not all to us.

But you are switching back to the topic of government debt.

Americans have been importing more than exporting for a generation. The current account deficit has tracked net oil imports pretty well. It is a real problem.

I don’t know if you’ve seen this equation before.

Exports – Imports = Savings – Investment

In other words running a current account deficit means your savings don’t cover you investment. That can mean investment is high and foreign money is flowing in (as in South Korea in the 70s), but in the case of the US it is low savings rate. Government debt is only part of that.

The dollar is not really in much danger in the short term because it is trusted, and because it is the grease in the wheels of international trade (outside the EU anyway). You can tell the dollar is trusted because the exchange rate rises in times of crisis. I understand that it would be a bad thing for the dollar to collapse, however. I would say money is trust, not debt.

I think it could be solved by taxing oil at the pump, which would result in reduced waste would grow the economy by increasing net exports.

The good news is that total debt (public + private) is falling in the US. We’ll have to see if that translates to reduced foreign debt.

In a final comment, a lot of people believe that current account deficits come from foreign competition. But at the end of the day the question is whether the country as a whole is spending more than it is producing.

Total debt is falling? Hardly.

Yeah, hardly.

Total US debt soars to nearly $60 trn, foreshadows new recession

America – its government, businesses, and people – are nearly $60 trillion in debt, according to the latest economic data from thethe St. Louis Federal Reserve. And private debt – not government borrowing – is the biggest reason for the huge deficit.

Total US debt at the end of the first quarter of 2014, on March 31 totaled almost $59.4 trillion – up nearly $500 billion from the end of the fourth quarter of 2013, according to the data. Total debt (the combination of government, business, mortgage, and consumer debt) was $2.2 trillion 40 years ago.

“In 50 short years, debt has gone from being a luxury for a few to a convenience for many to an addiction for most to a disease for all,” James Butler wrote in an Independent Voters Network (IVN) op-ed. “It is a virus that has spread to every aspect of our economy, from a consumer using a credit card to buy a $0.75 candy bar in a vending machine to a government borrowing $17 trillion to keep the lights on.”

Ahh expungement beckons. Probably via some redefinition.

$4+ Trillion of that is on deposit at the Fed as balance sheet Treasuries. They don’t have to be expunged . . . well, maybe they won’t bother to pretend. When those bonds mature and it’s time for Treasury to pay the holder, Treasury will do just that. And the Fed will return that money to Treasury, just as they do RIGHT NOW with interest payments Treasury sends to the Fed for those bonds monthly payout.

But that graph is somewhat bogus for another reason — that being the Fed doesn’t know . . . no one really knows, the value of mortgages on file a the big banks. They are still carrying those at full value, despite the fact that so many of them haven’t rec’d a payment from the house owner for 5 yrs.

Marvelous maneuvers take place on those, btw. When someone is 2 yrs in arrears and living in the house, the bank says, okay, we’ll cut your interest rate and your payment is now this lower monthly amount. Okay? The guy agrees. THAT MOMENT, he ceases to be delinquent. The clock starts again, and he never says a payment. He’ll repeat the process in a couple of years and say . . . look, just cut the principal. This house is not in Orange County. The price hasn’t recovered and it’s not going to, so just cut the principal since that’s all you’d get anyway if I walk away. The bank says no, but we can cut your interest again. The guy says okay and the clock starts again and that house is reported to the Fed or whomever as up to date.

The renegotiate approach worked on the way to ZIRP while there was still a good margin to play with but it doesn’t work as well once ZIRP has been achieved. Over time, as legacy high interest loans are payed off or refinanced, the banks have less profit to hide the bad loans with.

Doomsters are like, “I don’t have my cake and don’t eat it either”.

You have an excellent point.

Another point is that the elimination of old debts does not eliminate the potential existence of new debt.

Countries that have experienced runaway inflations and ruinous wars are still able to issue money and borrow money.

Ditto people who have gone bankrupt can still borrow money.

I do not however believe in a debt jubilee. The thought of my spendthrift neighbors getting off scot free and holding onto all the stuff they have bought on credit might drive me to the point of doing something irrational.

But the thought of my owning my recently acquired additional farm land free and clear without that deed of trust ( mortgage in most states ) is sort of attractive lol.

A quick stroll thru the Salem Witch trial archives will reveal that the people accused and killed owned land and if they died it was often the case that their wives or husbands did not inherit it. Neighbors did.

Neighbors did a lot of accusing.

Same in Rwanda. There was a quote somewhere: “The people who were killed were the ones who had cows.”

AND BEFORE I quit this topic of debt I want to say that as a practical matter Ron is right and dead center in the ten ring , given that we are locked into the existing financial system.

But there is an interesting side to a possible debt jubilee that has not yet been mentioned. The owners of all the more valuable assets after a jubilee would very often want to sell those assets for lots of good reasons and bad.

The only way the owner of a nice house ( for example ) could sell it in the absence of money lenders would be to sell it owner financed.

It would not take very long for capable and ambitious businessmen to accumulate enough money to do a lot of lending and thus allow the seller to get paid immediately.

I don’t think it is possible as practical matter to abolish debt in a modern society. It would probably be hard even in a mediaevial society.

Nope. I think I saw a recent statistic that 30+% of real estate sales are currently cash.

Obviously that is not home sales. When WalMart buys land or a building they likely pay cash. Ditto for many other companies. But if you are talking about personal property I would bet it is 95% credit.

No, it was houses. Single and multi family. The single family houses are being bought to rent out.

A lot of it is investors.

Another lot of it is foreign money.

(Russian and Greek money have held up the London house market for years. In fact, during the Greek 2011 apocalypse, that money was flooding into London so fast the buyers were not even bothering with an inspection. They needed to get their money out of Greece ASAP.) NYC and Florida and San Fran are getting the influx now.

It’s not the old normal, Ron. That’s all gone forever. ‘Twas a bit of surprise to me, too. It really is a big % of houses being bought and sold for cash now. No mortgage.

quite common here in So Cal

Bomb Trains Keep Rolling While Congressional Committee Bickers About Bakken Crude

Justin Mikulka, DesmogBlog, Wed, 2014-09-17 08:59

And from the Bakken Magazine I noticed this while reading an article there that Ron had posted. I think it would be fair to say that the ‘magazine’ is a cheerleader for the Bakken petroleum production…

Witnesses Backtrack on Bakken Crude Claims

By Luke Geiver, Bakken Magazine, September 10, 2014

The hearing included representatives from the U.S. Pipeline and Hazardous Materials Safety Administration (PHMSA), U.S. Department of Energy (DOE), North Dakota Petroleum Council, Turner, Mason & Co., and the Syracuse Fire Department.

During the hearing, members of the Subcommittee asked a representative of the PHMSA how the PHMSA knew Bakken crude was more volatile than other light sweet crudes. The PHMSA representative, along with another representative from the U.S. DOE on the panel, could not answer directly how PHMSA knew Bakken crude was more volatile. As the hearing continued, it was obvious the lack of information and the unacceptable answering ability of the PHMSA or DOE was causing tension and uncertainty about the PHMSA’s big Bakken claim (PHMSA released a report in July claiming Bakken crude was more volatile than other similar crudes).

See also this from the same site…

Bakken crude characteristics topic of U.S. House hearing

They, along with their congressional fellow travelers, seem to be engaged in an exercise in obfuscation. I suppose it is just an unfortunate observation that Bakken DOT-111 tank cars seem to blow up in such dramatic ways.

Who were the experts he asked for? And what is the Administration’s alleged agenda here? To improve oil output from a GOP state? Or to slow oil output from a GOP state?

The reality is the contents of rail cars from the Bakken vary so extremely in nature that sample sizes in testing them are probably far too small. Present regulations would suffice if they could be applied to each car. But these trains are 2 miles long and that’s a lot of cars.

1221 dollars for one troy ounce of 24 karat gold.

94 dollars for a barrel of oil.

How many barrels of oil can one ounce of gold buy?

You’re kidding me, right? Gold is n0where to be seen unless you are hoarding the stuff.

1221/94 dollars per barrel=12.989 barrels of oil for each ounce of gold you have, if you have one.

When gold was worth a twenty dollar bill that had ‘gold certificate’ at the top of the bill, oil was selling for about 1.61 per barrel. In ca. 1910, you received 12.5 barrels of oil for every double eagle out there.

It is the same trade today, but it is not the same. Lots of room for all kinds of shenanigans in the world of finance, especially with fiat clown bucks doing its magic, which obviously has taken us to the brink of financial disaster, which is not a real big surprise. Too much room for corrupt financial practices to occur, the accounting methods become convoluted, it just looks like big bucks, but it’s not. The lunatics are in charge of the asylum.

Gold and silver minted coin prevent such distorted nonsense.

Sow the wind, reap a whirlwind.

Hi Ronald,

This is the first comment you have made that I can wholly agree with without scratching my head trying to figure out if you are serious or just having some fun out of us or maybe smoking something that interferes with your train of thought lol.

There is only one real problem as I see it with money based on precious metals. There simply is not enough gold and silver or platinum or anything else out there in sufficient quantity to use it as the basis of money.

The universal tendency of politicians and bankers to inflate money makes it impossible to use precious metals as backing for paper or electronic currency.

If you base money on gold supply, you open up the Goldfinger scenario as a new form of terrorism. This is all old arguments.

In 1988 I bought ten 10 foot lengths of half inch copper pipe for 2.76 usd. Today, the price is 4 to 5 times more. What cost me for ten pieces now buys two 10 foot lengths of copper pipe. The 2014 dollar buys 20 percent of what a dollar did in 1988. Eventually, inflation will kill the goose that lays the golden eggs.

A copper penny minted before 1982 weighs approximately 3.1 grams and is 95 percent copper. If you multiply 2.95 times 154, you will have approximately one pound of copper pennies, pre-1982. 5 percent is zinc content, so there is some monetary value there too.

Copper has a price of 3.13 usd today, so your 150 old copper pennies are worth double the face value.

A 95 percent copper US minted Lincoln cent is worth 2 cents, not just one cent.

It costs one old, tired, worn out penny these days to add your two cents. Some things do have value and you save money too!